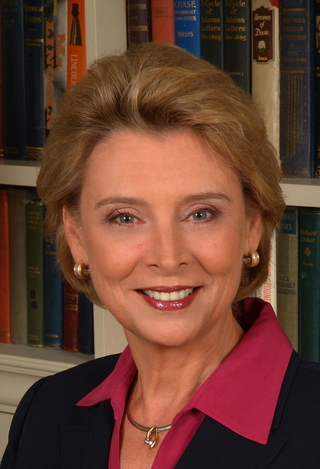

Gregoire Signs Payday Loan Reform Bill

By Keith Vance

May 18, 2009

The new law requires that all payday loans expire on your next payday, unless your payday is less than seven days away. This essentially makes it illegal to offer loans with terms of less than seven days and lengthening the term of these loans to the next payday.

For instance, if you get paid on the first of the month and need a loan on the 25th, because your payday is less than seven days from the start of the loan, you’ll have the entire next month to pay back the loan. Since the loan fees are remaining the same – $15 on every $100 – but the length of the loan is increased, at least in this scenario, the A.P.R. goes down considerably, to less than 200 percent.

Of course this new regulation only applies to loans currently offered that are less than seven days, the majority of payday loans are typically for about two weeks and will not be effected by this change.

Perhaps the more dramatic change is the option for borrowers to get on a three or six-month payment plan if they fall behind with a payday lender. The payment plan will be available to anyone, and unlike rolling the loan over for another pay period and incurring new fees, the payment plan is free.

The new law also limits the number of payday loans to eight per person per year, and to not exceed 30 percent of their gross salary. To keep better track of borrowers, payday lenders will be required to enter borrower information into a centralized database that can be used to verify whether there are any outstanding loans.

And evidently prior to this new law, borrowers were not allowed to sue payday lenders under the Consumer Protection Act, but now if lenders break these rules they can be sued for up to $10,000.

Last month Harpers’s Magazine reported that in the early 1990s there were fewer than 200 payday lenders in America, now there are more than 22,000 serving 10 million households each year. It’s a $40 billion industry with more stores than McDonald’s.

--

“Welcome to the birthplace of payday lending” by Daniel Brock for Harper’s Magazine

Payday loan calculator Missouri Attorney General

“More on the payday lending regulations and how they work” by Niki Sullivan for The Capitol Record blog.

Engrossed bill as passed by legislature.